+$1,408 today trading AUPH, VRX, MYOS. Making progress on eliminating one of my weak links!

Today was a good day. Some good profits, some reminders on my trading, and making progress towards becoming a more disciplined trader.

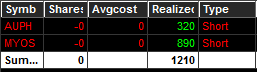

AUPH was gapping up huge pre-market due to positive drug study results. I fully expected this to para at the open for a short. I was surprised–I think along with a lot of other people–to see that it just tanked. I ultimately decided to short on the rebound towards VWAP with 5.60 area as my risk. The trade plan was solid but how I scaled into it was not. I started in too big and added too quickly for the range and for where my risk was set. This made me nervous as it tested 5.50 because my $ risk by this point was to big. This heightened risk caused me to not want to be patient on the trade to protect myself, so I cut it off way pre-mature. My less then ideal execution of the trade turned what could have been a killer trade into a sub-par trade. This trade was a good reminder to keep a closer eye on the range when adding into a trade and to not let fear of missing out on further downside cloud my trade execution.

MYOS has a little of the same story. I knew this could have wings so I prepared for that, but in retrospect I did add a little to much size at the open. I jumped in with 1K shares and added another 1K too quickly for the same reasons above. I should have waited to add that extra 1K later. Overall I was more confident in this trade plan. When it stuffed the new high twice just before 10am my confidence increased. I was a little to quick to take profits on this one though. I was planning on taking pieces off lower, but didn’t. I thought to myself, “sweet, I just passed 1K on the day, lets just be done.” That is classic letting my P&L dictate/change my trading plan instead of price action.

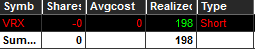

VRX, though the profit was small I am very happy with my execution! I originally wanted a push at open, but that did not happen. I changed my plan and I started in small on the rebound with HOD as my risk. When the trade did not work and it hit HOD, without hesitation I took the small $120 loss and that is what I am so proud of! That might sound funny, but in the recent past I usually would have gotten stubborn on this type of trade since I still had small size and the loss was small. I would not want to take that loss and try to turn it into a winner. Instead I followed my trading plan and tackled it again, with 50% more size when it set up better. That is exactly what I have been working on to overcome. If you have been reading my blog you know that stubbornness on taking losses has been one of my “weak links.” It has caused massive losses for me in the past. I am proud to see that I am making some progress toward eliminating that weakness!