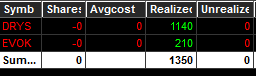

+$1350 today on DRYS and EVOK. Ending a bad week though after another stubborn hold on AKAO.

DRYS I went in short on the rebound after the morning wash with HOD as my risk. I am particularly proud of this trade because I added into my winner. I got one add and then did not fill on a second add, but that add order was in which is what was important. I covered the last piece at almost dead bottom for the morning. I did not re-short mid day because it was holding the lows so well. It was 50/50 imo on if it would pop back green or continue down further.

EVOK I shorted on the morning pop with HOD as risk. It broke that HOD and I covered–big accomplishment for me lately! I then attacked it short again once it failed at the new HOD. I shorted another time on the test and reject of HOD.

This week I got into a stubborn hold trade on Monday with AKAO. I exited that trade yesterday. This trade whipped out this entire months gains and then some. I wanted to re-cap a few things with that trade for my future reference. The day I started to short, I waited all day to get in, but when I did finally start to get in I went in with Guns blazing. I had no risk level, no stop point. I did not care where my unrealized loss was. I just started attacking short. For some reason I was convinced it would crash and I wanted to bank. I saw $$$ signs. Second, I did not get out when I had the chance pre-market the next day for a small +/- 1K gain. I let $$$ influence me again and kept adding. Third, I did not really have a trading plan so I got stubborn and held. I made many mistakes on this trade, but these are the highlights.

Strategy Changes:

As a result of this big loss I am making a few adjustments to my trading strategy. One, I will start to use hard stop losses for my planned stops. I will continue to do this until I can trust myself to exit a trade when I should. Second, no more front side shorts without some sort of pre-determined stop based on resistance levels. Preferably my stop will be a HOD or close resistance point (Just like my two shorts today, I waited for a top to be put in before shorting and used that as my stop). No more max $ stop losses as my stop for front side shorts. Third, no unplanned adds until trade is confirmed or already a winner.

My consistency is great! But my risk management is poor due to my weaknesses here. This is keeping me from maintaining profitability. I let one trade get away from me and I wipe out weeks of hard work. I tried to fix these things on my own all year, but to no avail. So now, I am removing the emotions by using hard stops. I will document and track any trade where I do not follow these new rules until I can feel comfortable I have eradicated the issue. I will report on those at the end of each week.

Very good write up!

Thanks!