+$657 today on CNAT, but up +$2500 the past 3 days after strategy adjustments!

My play of the day today was CNAT. I sat on my hand right at the open because I honestly had no clue which way it could go. It was moving so fast. Also, I did not feel there was a good stop loss point yet to base my trade on (a key aspect of my trading strategy adjustments) It then looked to stuff $5.25, which was a key area pre-market. Because of that stuff, I decided to short on the rebound as you will see in the chart below. I went in with 5.25 as my risk. It broke that HOD and I cut my losses. Even though that first traded ended with a $600 loss, I am very proud of my execution on the trade. I followed my strategy adjustments to a “T.” I did not add when it started to rebound further, I had a clear trading plan, and I followed my trading plan by cutting my losses.

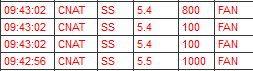

I went in again this time with a set risk on $6. I entered right when it looked to be stuffing $5.50, and sure enough it did stuff that price. I was quick and got a top tick entry on my re-short! I added on what I felt was the stuff confirmation on the next candle and moved my risk down to $5.50. I decided not to add again on the small rebound before the big crack because I did not want to lower my average more and panic out of the trade since it might just hold VWAP at this point. I felt that my $ risk would be too big if I added again. I started to cover the trade into the pull, closing the trade making back the $600 loss and up to $657!

Over the past 3 days, since I made my trading strategy adjustments, I am up $2500. I am pleased that I am getting back to trading with discipline and seeing some nice profits as a result. The doubles and singles have added up.

I am leaving today for my wife’s grandmothers funeral that is in Utah this week so I am done trading for the day. I am bringing my travel trading set up with me and hope to try it out for the first time while on the road.

What platform are you using in that chart above?

DAS trader pro

Sick entry bro. I have a similar trading style. Did you perfect determining the point of inflection (the top of the “stuff”) by just trial and error? It becomes more of an art than science am I right about that? Awesome blog by the way, looking forward to read more and best of luck trading.

Thanks! Not sure if I have perfected it yet, but working on it! 😉 I agree with you that it is partly an art or feel that comes over time seeing the stuff moves on level 2, time and sales, and the chart.