December is in the books…

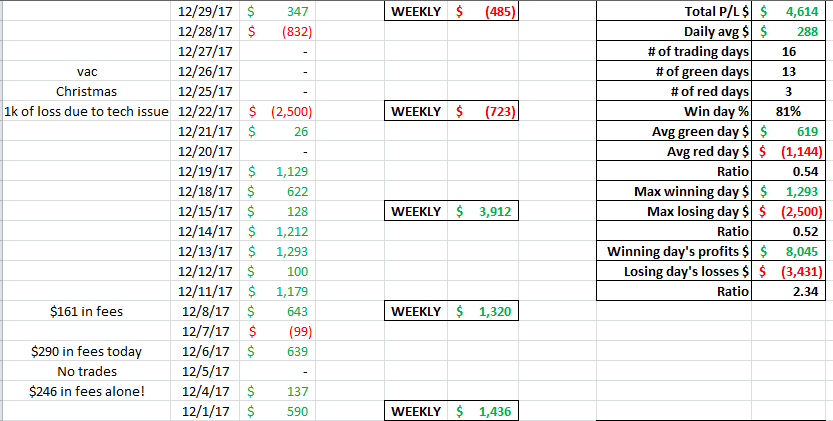

Overall I am happy with my trading this month, though it is a little bittersweet. I had a very strong start to December. Was up about $7500 just before Christmas then gave back $2,900 of it from the 22nd to today. That is the bitter part, lol. But I had some strong consistency and made some great progress on getting back to quality trading.

I had only 3 red days this month and an 81% win rate. I am happy with that consistency. The large loss on the 22nd is frustrating though. Had two major platform issues that caused about $1000 of that loss. Those have since been worked out/ figured out, but it is just disappointing. Given the smaller size I have been trading, I am thrilled with my average green day and up until the 22nd, I was very happy with how well I kept my losses in check. Though the 22nd is disappointing, it is not a blow-up nor was there any stubbornness on those trades. Just platform issues and too big of size for the range of the stocks I traded that day. Got a little to short-biased that day with the weakness in crypto land.

You will note below that I was getting killed on fees the first week in December. I had been using FAN route to trade these blockchains. I have used FAN since I started trading with Center Point and never had an issue until now. I realized after a few days that the route stopped giving me rebates on some of these blockchain stocks. Once I discovered that I switched to ARCA and my fees dropped drastically. I am now getting my rebates again for adding liquidity. I have really liked the ARCA route and I plan on staying with them. I have only been forced once to use FAN once since the change because the ARCA route did not work on NXTD the day I traded it.

I made one major change to my trading this month I think is working well that I picked up from LiveStream Trading. My tape reading skills have gotten pretty good and I was noticing that I often would nail the perfect entry on my initial entries. This was great except I would not be sized in. I usually only had 1/3 size and then the stock would drop in my favor. If I tried to add I would kill my average and then get shaken out of the trade. So I decided to try focusing on the correct/better entry, starting in with more size from the get-go, have a more defined risk level, and not worry about trying to add. I saw Jeff on the LiveStream do this all the time. Doing this has almost doubled my average win rate from last month. My risk on my trades are much more controlled as well. Never once have I risked my max trade stop loss this month. I used to risk that almost all the time when I would scale in on the run-up since there was no defined risk point. My nerves are a lot less on edge since my risk is small and set. However, there is some downside to trading like this. Becuase I am more picky about my entry it can result in missing more trades than usual. Becuase I jump in with more size expecting my entry to be the end of the run, I can also get shaken out a little more often if I am a little early. That can be a commission burner. Overall, it is working well so far so I am going to work on tweaking it to improve how I am managing these types of trades.

So all-in-all I am very happy with my progress this month. My confidence has taken a great leap forward and I feel like I am getting back to where I was before my losing streak.

How do you know which ones to look after before you purchase? I am totally new at this but I have a few dollars I’ve been playing with a friend of mine’s following somebody but he won’t tell me on Twitter so I decided to get a Twitter account and start calling you and I was curious how do you watch him to figure out which one to watch next? Great job on your winnings I know there is a loss and win when you buy stock and I have to congratulate you could very well

I use a simple top % gainers scan in the morning to identify plays I am interested in.