-$1,286 today. I went 1-5 today. This is my worst performance this year, but not my worst loss and that makes it a huge win for me today!

Why do I consider today a win? Well, in the past I have let days like today destroy me. I would get emotional and revenge trade. I would not stop out and hold. Last year stubbornness on taking losses killed me. It was my biggest weakness and stood to destroy me as a trader. I have been working so hard on overcoming this flaw. Today showed that I am making great progress overcoming that weakness. My biggest most deadly weakness was tested big time today, and I came out victorious. I could not be happier!

If you have followed my trades you know that I do not usually chase weakness on shorts. I like to short near the top of runs and I am good at doing that for the most part. I especially don’t chase weakness on charts that are gapping down huge like MBRX. But today, I guess I let some FOMO get the best of me and I chased MBRX and CHFS short. I thought they would be much weaker than they were and I was wrong. The silver lining on these trades today–as mentioned above–is that I stuck to my trading plans and did not get stubborn. This allowed me to keep the losses under control. This in my book makes today a win!!

I want to etch a few of these charts into my mind’s eye as a reminder why I don’t chase weakness! It’s vital that I learn from these plays today.

MBRX I shorted after it pulled hard below VWAP. I started in 1/2 size and planned to add if it popped to 2.20. It did exactly that so I added. My risk was on HOD. Sadly, it was stronger than anticipated and it broke that high. I stopped out at HOD for a $502 loss. As mentioned above I should have never shorted weakness on a stock like this. Yes, it ran big yesterday, but it gapped down big this AM. It was bound to have some sort of relief rally at some point. I just so happen to short into that relief rally. The real short here was when it stuffed in the mid 2.40’s. Such a shame I let FOMO get the best of me on this one. Lesson learned and loss deserved.

CHFS I chased the short on that first red candle. This gave me a very poor average. On plays like these, I usually wait to see if it will pop again before I short, but I didn’t today. Pure FOMO on that entry. My plan was to cover if it broke HOD and it did. I then chased it short again when it broke VWAP and covered at my planned stop at 1.50 as 1.50 was the spot I felt meant I was 100% wrong and it was not going to continue down yet. I did not take the next short on the reject of 1.65 because I was in CBI and if I was wrong on both plays I would likely be over my daily max loss. Sucks, because that was the correct short on this stock. But, unfortunately, I was in that position where I could not take the next short because I chased the other two tries. Both losses added up to $500.

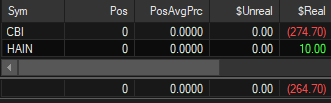

CBI was a long play. The first long I had 0 regrets on. It was a solid plan according to my strategies and it simply did not work. That first long started to work but then it came right back down to my average. I stopped out for basically breakeven. Then it looked to hold the LOD and I chased it up. Man, you would think I would know better than to chase by this point! Anyway, It did not work and I stopped out for a $274 loss. I tried one more long with $20 as my risk this time. $20 held, but my average was not good. I also wanted to make back my losses today so I did not take any off when it held resistance at 20.5–another no no! I was determined to be patient on the winner so I did not lock some in–shame!. I know better and had just had a conversation about not doing that with another trader yesterday! lol! It rejected the 20.50s so I covered for breakeven. At least I did not add to my losses.

HAIN was a pretty solid plan just did not work well. I scaled in shortly after it cracked VWAP with 39.00 as my risk. I knew that it had to break the 38.50’s to confirm it would work. If it broke I was taking 1/2 off near LOD and the rest on a brake of those lows. Sadly it held 38.50 so I took it off at break even as well. $39 resistance ended up holding again but it could have just as easily not had. It wasn’t worth the heightened risk when it held 38.50 so well.

At this point in the day, I was able to recognize that today was not my day and it was time to call it quits. I did not hit my daily max stop loss for the day, but it was obvious luck was not on my side. No point in giving more to the markets. Today I traded like a rookie, but I held to my plans like a pro and stopped out when called for. My risk management was well in check and the losses today–though they added up–did not decimate me. In my opinion, this adds up to a win.