+$269 today and I consider myself lucky that I ended the day positive. I traded things I had no business trading–UVXY, NUGT, NVDA–and missed the things I am good at–KOOL, CNAT, KATE.

I started my day super focused on NVDA, causing me to ignore everything else this AM. First off, I don’t usually trade $100+ stocks–especially when they have the range like this one. The risk can be so high. So I was out of my comfort zone and nervous. Basically, I was trying for a bounce to 107. I figured it would bounce after the hard pulls today and yesterday. Turns out I was right, just my executions were off. I had some really good entries and was up over $1000 on 2 separate long trades, but I would not take any off (in the name of being patient) since it did not hit my profit target and would stop out at break-even. I stayed very disciplined though and would not add or move any stop losses, thank heavens! I allowed patients to cause me to ignore price action and it bit me in the butt. My true issue though on these long trades I think was my stop loss targets and not sizing in. Because of the range, I tried to nail the trades right away with full size. Had I had a better stop loss like LOD or 103.6 and sized in accordingly, my entries would have been perfect and I would have been much less nervous. The way I was trading it caused me to get chopped out and take some unnecessary losses.

I also tried two shorts on NVDA. The first one was with 108 as my risk which I stopped out on. The second was with r/g as my risk. That one ended well. I added on the reject of HOD and covered for what ended up putting me at a gain for the day.

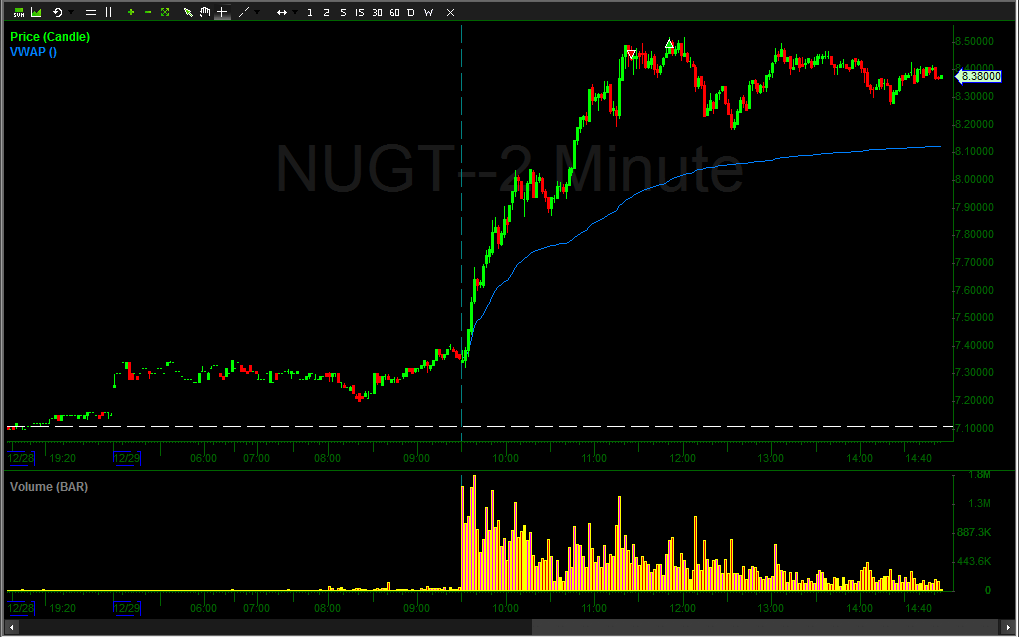

NUGT, in all honesty, was 100% a FOMO trade. I saw Nate at IU go in short and at this point of the day I was frustrated with my NVDA trades and decided to follow him in the trade. I wanted to make back my losses and was afraid I would miss out on a big win. I shorted 5000 shares with 8.51 as my risk. DUMB!!!!! I used a hard stop loss and stopped out at 8.51. It went only .01 past my stop and finally fell. I deserved this loss.

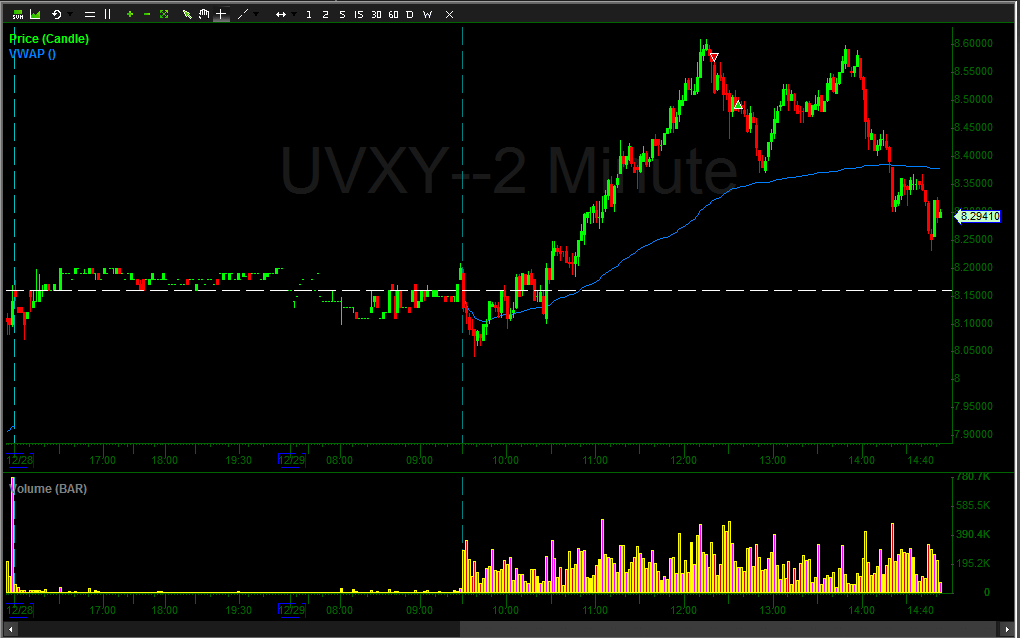

UVXY I rarely trade and really should not trade it as I have a hard time finding an edge. But I stayed patient waiting for what I felt was a bounce on the SPY to go in short on UVXY. My entry was great, but I entered in full size hoping for a big win. This caused me to be nervous and I exited for a gain way too soon. My exit was 100% emotional as was my entry with full size.

My take away from today’s trading: WALK AWAY! 🙂 There were multiple times today that I could tell my head was not in the right place to trade. I even told myself multiple times that I just needed to walk away. I was being too emotional in my trading and I could tell. It’s ok to have an off day. It happens. And it is ok to take the day off when you notice it. What is not ok though, is to continue trading when you know you shouldn’t. That was my mistake today. Even though I noticed I was not in the right mindset, I did not walk away from the computer when I knew I should have.

I’m walking way now though!