Last week my trading was a little all over the place. I had more red days last week than I have had any other week this year. I increased my trading size two weeks ago and that has proven to be a little more difficult on my mental game than anticipated. I spent the weekend contemplating my trading from the last week and reviewed my charts.

Despite the losses, overall, I am proud of my trading last week. I had some great trades. My biggest loss was due to a stupid mistake of not putting on a stop loss order when I left the house that I wrote about here. That mistake cost me $6500 + commissions. However, in just two trades after that, I made back all the loss. Those trades were not revenge trades, but controlled and calculated. Then on Friday, I started too early on TEAR which caused me to stop out at my max $ stop loss of $3,000. I ended up making almost all that back as well with some good quality trades. However, I did not lock in profits on those trades like I should have…aiming to make up all my loss in a single trade, which cost me. I was up $2500 on two trades after my max stops out. I did not lock in and ended up covering both of those trades for a few hundred in gains–this killed me on commissions. It was my third traded where I finally locked in and made most of my losses back. Fixing a few things last week could have resulted in a record week for me and that is exciting.

There are two things I feel like I could have done better last week which would have greatly improved my outcome. First, not letting my P&L influence my trading. Two weeks ago I increased my starter sizes and max trading size. This has proven somewhat challenging. It has brought back some of the old habits of trading for gains instead of focusing on quality trades and letting the profits come to me. There has been some forcing of trades to get profits. And emotions have been a little high on some trades. Almost each of my losses last week can be linked directly to me trying to force profits. Trading has been slow for me this summer and I want the gains I was getting before summer. This has made me make some poor decisions which I call letting my P&L influence my trading.

I was reading an article today on how Athletes keep the right mindset to perform at their best. There were some great parallels to trading, but one take away had to do with what I have been struggling with on letting my P&L influence my trading. It shared how one athlete let the contract $’s of his team member destroy his focus and really affect his performance. He was thrilled with his contract pay at first but then it felt like it wasn’t good enough anymore when another player’s pay was better. I have done this with trading. Somehow, I have let other’s P&L success affect me this summer, which has never happened before. I have always let others success inspire me. But my trading has greatly improved and I know I am capable of achieving what they are achieving and it bothers me that I am not. I think it all comes down to how this really slow summer right after a few big losses has affected me emotionally. It is not anyone’s fault but my own. I need to fix this, but I am not 100% sure how. (If you have ideas send them my way!) So I am going to try and eliminate the “noise” on Twitter this week to see if that helps. Pull back some from reading twitter during the trading day. Shut off the bragging, chest pounding, and etc. Stop comparing my trades to others, or my P&L to others P&L.

To hone my trading even more, the second thing I can work on is how I add to my trades. When I start in short on a front side parabolic I always leave lots of room to add. When trading the front side I recognize that I might not hit the top and that I have to leave room to add. Generally, I am very good at this. I often come very close to top ticking para moves. I do a great job reading the level II and the tape to be able to tell when the move is over. However, when I start into one of these plays and the stock is not done running yet I tend to add in too quickly. TEAR was a great example of this on Friday! I added in too quick and got stopped out right before the big para move was done. For some reason when I am wrong on the where the top is on a para move I stop my level II and tape reading and just add in on every pop. I think this comes from a fear of missing the good add to increase my average before the big pull. Not a good thing to do on these types of plays. So, now that I recognize this flaw (which is the first half of the battle) I am going to focus on improving it. I will work at not adding again until I can see what I look for to get in a play in the first place. Don’t rush in!

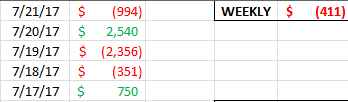

I do not regret increasing my size, but I have a few things to work on this week to get back into the right groove. A net loss of $411 is not bad considering, but I could have performed so much better this last week. I want to try and eliminate some of the fluctuations on my P&L this week with more disciplined trading.

Trading is truly a journey. It is a journey that will highlight all your weaknesses. It will try you in more ways than you thought even possible. The awesome part though in my opinion, is if your willing to look those weaknesses in the face, take them head on, it can not only make you a better trader but a better person as well!