This week I had an epiphany of sorts, an “a-ha” moment that was quite impactful for me.

At Traders4Acause this year I got the opportunity to speak with ModerRock. During our conversation I asked him about risk management and how he determines his stops on his trades. His response surprised me. He explained that he does not use traditional stops, he uses a time frame. He will “keep adding to the moon” but will stop out on that trade if it does not start to work by 11-11:30. If it is still strong by that time he will get out. Stocks that are still strong past 11-11:30 tend to keep running he explained.

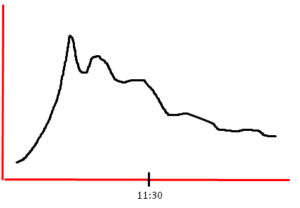

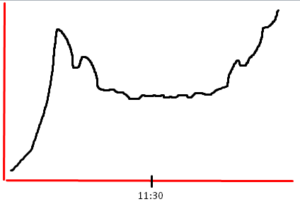

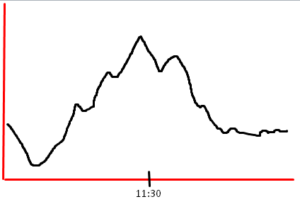

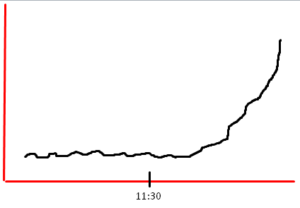

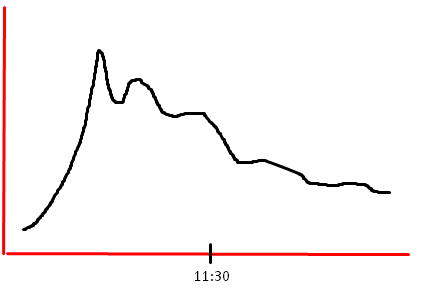

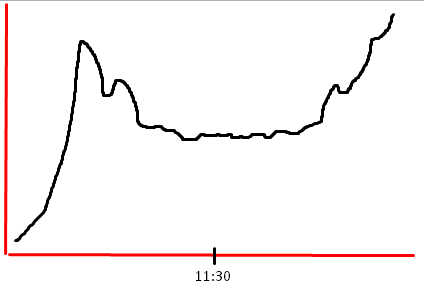

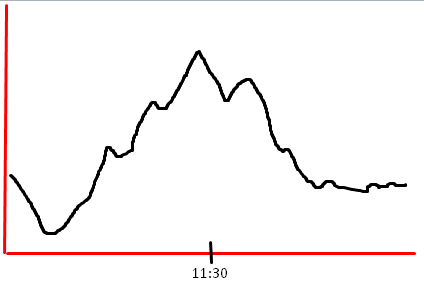

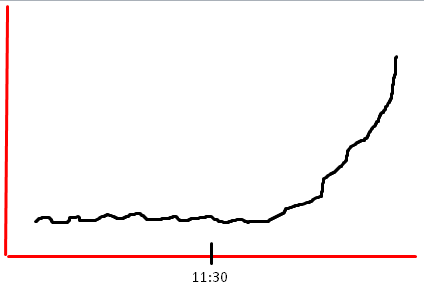

This conversation was impactful to me so much so that I still remember it in great detail, however, I never really acted on this information… until this week. This week I spent time reviewing my past charts. I have had kind of a rough start to the year and was wanting to see if I could figure out why. I went all the way back to August 2017, when I first started keeping copies of my charts and set ups. I reviewed a few hundred charts and during that review this exact thing ModernRock explained to me stuck out like a sore thumb! The proverbial light bulb came on! The validity of what he explained to me that day jumped out to me. I saw that a majority of my larger losses came when I was trying to short aggressively after 11:30. I saw that a vast majority of my gains came on charts that pushed prior to this time frame. For the first time I finally “saw” 4 common patterns as clear as day that have repeated over and over and over again. I have drawn those for you…

Though these drawings are not pretty, it was uncanny how similar they are to actual plays I saw or traded since August. Here are some very recent examples from the real world…

Just like the first drawing above CNIT on 1/5 went para at the open and then just tanked all day. I made a very nice gain on this play. These types of plays tend to be my most profitable but I often exit to early and leave alot on the table.

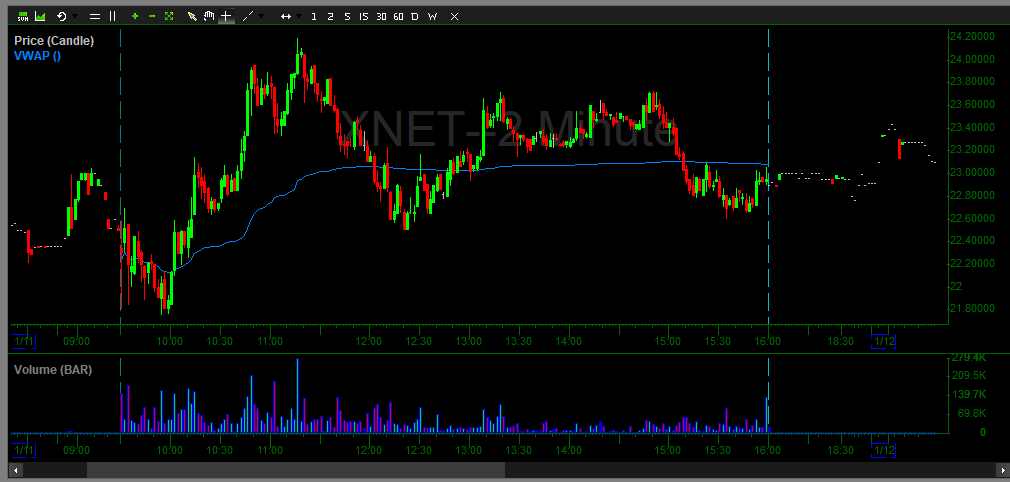

This one is identical to the 3rd drawing above. Dip in the morning, push hard up until before that 11:30 range then it made for a nice short. It also made for an even better long on the dip reclaim. I missed this trade sadly.

I am sure we all remember this one on 1/4. It is identical to the 4th drawing. I had a sizeable loss on this day trying to fight it short. I did not get stubborn and add to a loser, I just kept jumping in over and over trying to nail the reversal causing many stop outs that added up quickly. You will see that once it was well past 11:30 and still holding it ran all the way to 12. These don’t always run of course, but when they do boy they can kill.

MYSZ here is very similar to the second drawing. It had a nice r/g morning push at the open but then was holding after 11. Once it decided to run (they don’t always run of course if they are holding after 11 but when they do, shew…) it ran far and hard.

There is one exception to the second chart drawing above. And that is something Tim Grittani talks about in his DVD, a pre-mature breakout attempt…

This chart is very similar to the second and third drawing above except it failed its b/o after holding. I find this happens at times when a stock that is holding attempts to b/o to soon. They can make for great shorts on the failed b/o. There were two great short attempts here, after the failure to keep running after 11 and on the failed b/o late day.

You will notice a common theme amongst all of these charts and that is the 11:30ish time frame. That seems to be a make or brake time for most stocks. If it is holding at that point it has a good chance of running again like MYSZ did. If it runs after that time it can run very hard and much further then one would imagine just like CNET did. If the parabolic happens at the open it can make for a great short that fades all day like CNIT did. If it dipped but then ran hard before that 11:30 time frame it can make for a great short around that 11-11:30 mark like XNET did that day. I think ModerRock was on to something!

These stocks above are just a few examples. Sure there are always exceptions to these patterns and they don’t always work but the fact is these are very common patterns that happen over and over again. I could give you many more examples! It is all about probability. When something is pushing or holding after 11:30 the probability of my short working is much less. I need to step back and stop fighting at that point. This is what I have noticed. I loose more after that time frame. I am not sure why I failed to truly see these common patterns until now and implement rules around these patterns in my trading. Not understanding these patterns has cost me alot in losses and missed gains. But I am seeing them now, something finally clicked, and there are some big takeaways for me…

I can be more aggressive on these shorts. These are my favorite set ups and most profitable. Scale in or wait for lower high/stuff. I need to keep a piece on to maximize my gains. No reason to cover it all up right away like I usually do.

I can be more aggressive on these shorts. These are my favorite set ups and most profitable. Scale in or wait for lower high/stuff. I need to keep a piece on to maximize my gains. No reason to cover it all up right away like I usually do.

Take the trade of when it hits my average if I have any left and don’t try to fight. Let it run. Don’t keep jumping in trying to nail the top. I will just give away all my gains from the morning short. This pattern often coincides with a vwap reclaim. Wait until tomorrow to try any more shorts. Learn to long them on the vwap reclaim after consolidation.

Take the trade of when it hits my average if I have any left and don’t try to fight. Let it run. Don’t keep jumping in trying to nail the top. I will just give away all my gains from the morning short. This pattern often coincides with a vwap reclaim. Wait until tomorrow to try any more shorts. Learn to long them on the vwap reclaim after consolidation.

Be patient on these dip reclaim plays. Wait longer to start in and for a confirmed reversal. I tend to get stopped out alot on these because I try to short to soon. If it runs hard prior to that 11:30 time and then fails I can get short at that point. I also need to learn to long these runs.

Be patient on these dip reclaim plays. Wait longer to start in and for a confirmed reversal. I tend to get stopped out alot on these because I try to short to soon. If it runs hard prior to that 11:30 time and then fails I can get short at that point. I also need to learn to long these runs.

Stay FAR FAR away from these short. When they run like this late day after that 11:30 time frame they can kill early shorts. The probability of my short working is extremely small. I will just get chopped up. Look for longs on these instead.

Stay FAR FAR away from these short. When they run like this late day after that 11:30 time frame they can kill early shorts. The probability of my short working is extremely small. I will just get chopped up. Look for longs on these instead.

It’s pretty clear to me now why I was struggling the beginning of this year. I was fighting stocks like CNET I had no business fighting causing unnecessary losses. Or I was jumping in to soon on dip reclaim plays like CNET the day it dipped and ran. I was also hesitating on taking positions that I should have jumped in with both feet like on XNET the day of that dip reclaim! Understanding the big picture patterns (not just the price action) I am looking for and being able to review my past performance on these plays is a huge competitive advantage. I am extremely grateful that I started journaling all my trades and set ups. Being able to review those things was powerful for me this week and helped me have this “a-ha” moment.

Very interesting blog. I have always tried and gone long if a stock holds after 10:30 am as these have always been my best setups.

I am extremely grateful for your explanation about timming to trade.

God bless you

Thanks for the article. Reviewing my own charts now, I see that 11:30 is a clearly important time in the market. I’m looking forward to seeing how things go in the live market next week.