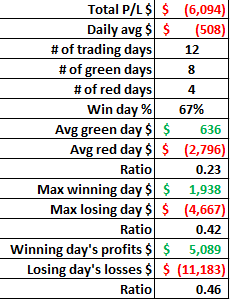

Good riddance August! My second worst performing month of the year and slowest trading month I have ever seen (well in my 2 years of trading at least, lol!). I should have just stayed on vacation.

August was hard, not going to lie. It was hard mostly because of how slow it was for me. Very few ideal set ups and I could not get any good size wins. The hardest part of dealing with this type of month is keeping the itch to make money in check. My two biggest losing days this month were due to me not keeping that itch in check. The first one was a bout of stubbornness trying to force the trade to work. This caused me to stop out at my max daily “OH CRAP GET OUT NOW YOU SCREWED UP YOU IDIOT” number. My second one was taking a trade on a non-niche setup with too much size, trying to force a big win, getting stubborn, that also caused an “OH CRAP” max daily stop out.

Now for the good news. I am making continual progress on my stubbornness issues. That weak link in my chain is getting stronger. I can hear you saying, “now wait a minute, your two biggest losses were caused in part due to stubbornness.” Yes, that is true, but I did stop out!! In the past, I would ignore my emergency brake and keep holding until I hit a brick wall. This caused massive losses of up to +30K! Remember that P&L chart pinned on my twitter account of 2016? Yea, I’m not proud of that. My losses on the two trades this month were big, but they were not account destroying losses. I can recover from those. On both occasions, I recognized my stubbornness and put in hard stop loss orders at my emergency get out number. That’s a huge step in the right direction and one I should be proud of. Now let’s take that to the next level and eliminate the stubbornness that got me to that number in the first place.

The reality is, it’s hard when you see others making bank and you’re not. Keeping your emotions in check is hard enough, but when you add that in it can get really hard. It gets even harder when your desire for success is so strong and you’re not yet hitting your financial goals on your arbitrary time line. The market can care less about your time line. The key though is patience and perseverance. I am lucky to have a wife that is super supportive and helps me remember that. She helps me see the bigger picture and be grateful for the immense progress I have made thus far.

@Canny4 and @moderrock had some things to say this week that were impactful to me on this topic. I’m grateful for their reminders…

Point is don't be discouraged if u are not one of the few who get it quick. Most who make it have to grind for years honing the craft.

— Tom Canfield (@Canny4) August 31, 2017

As in anything worthwhile, you make it by a refusal to quit. It is a survive or die trying mindset. U cannot be casual. U cannot be weak.

— Tom Canfield (@Canny4) August 31, 2017

THEN, after ur self indulgent pity party is over, YOU GET BACK UP AND KEEP GOING. That is what separates winners from losers. Get back up.

— Tom Canfield (@Canny4) August 31, 2017

People, lets be clear… You fall down, you get up. You fall down again, you get up again. Success is a function of resilience in failure.

— Tom Canfield (@Canny4) June 28, 2016

Patience is not passive, on the contrary it is concentrated STRENGTH

Have strength to wait, strength to take losses, strength to do nothing pic.twitter.com/mS3mTvMCgb

— Modern_Rock (@modern_rock) August 29, 2017

Guys, if your in a similar position to where I am at, know that I understand 100% what you’re going through. Hang in there. We all have to pass through the fire to get to our destination. Becoming a successful trader is a long arduous journey. It’s one I am willing to take!