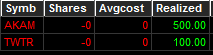

Kind of a slow day today. +$600 trading TWTR and AKAM.

TWTR was a short in the AM after the morning para. I stopped out once when it broke HOD but then got back in after it appeared to be toping. I sold most into the pull below VWAP. The small piece I held I covered when it ramped hard above VWAP towards break even. Not much in the way of gains though since the big pull did not happen until after FOMC.

On AKAM I started in thinking this thing would hold red again today. I started in 1/3 size just in case it decided to test that HOD risk. And test that HOD it did. I added into the push. Shortly after the push it became evident to me that this thing was starting to trade with the SPY and sure enough I was right. When the SPY pulled, it pulled, when the SPY ramped it ramped. I covered all but a small piece on the panic after the FOMC minutes were released. I knew that usually the first sharp direction the SPY moves in reaction to FOMC is not usually the correct direction. It will often times go right back in the other direction even harder. Sure enough it did that. I saw that the SPY was about to reverse so I tired to cover the remaining 500 shares around 67.50’s on the bid but never got filled. Its spiked hard with the SPY so I smacked to offer to get out before it went red on me.

I missed the big play on UVXY today because I was dealing with AKAM. Darn!

I tired to short SKLN today as well at $4.00 but I never got a fill. Darn again!